Easy Way to Raise Credit Score!

Must Know Before Buying a Credit Repair Software

Because of the recession, the number of people who have negative information on their credit reports is out of control. This has paved the way for various credit repair software to emerge and thrive in the market. For people who owe a lot of money and are looking for ways to help them manage their debt, one way to fix it is to find a reputable program that can help them. These programs were created specifically to help borrowers manage their debt and find effective ways to repair their credit report. So how exactly does the credit score software do this? Here’s what you can expect when you get one of these programs.

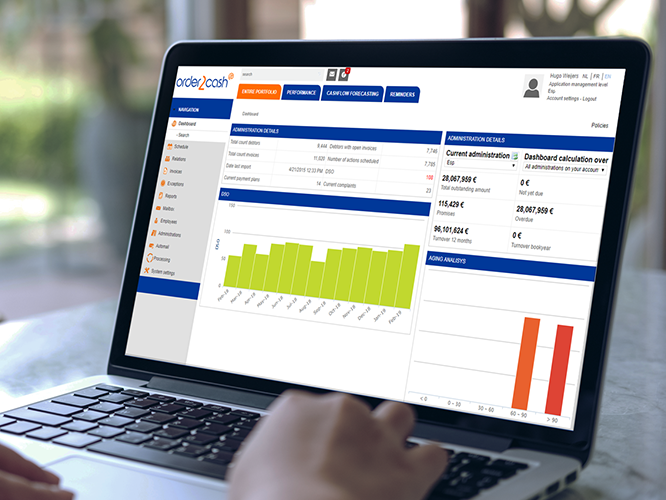

First, you can expect the credit score software to give you access to reports generated by the three national consumer agencies, as well as your scores. This will show you the reality of your situation and let you know which transactions are lowering your score. He will also give you tips on how you can boost your credit score on a short-term and long-term basis.

Management Software Tips and Advantages

Next, you will be able to see all your debts and the details related to these accounts. You need to look through them to find out which ones are legit and which ones aren’t. Incorrect data must be removed to improve your credit score.

Third, it will give you access to progress trackers for your personal use. It should give you step-by-step instructions on what to do, how to do it, who to contact, among other things. Once you complete a task, it is crossed off your to-do list. It will remind you when you should expect an email, when you should take next steps, or when you can remove a task from your list.

Fourth, it should contain pre-written credit score software templates designed to convince consumer reporting agencies to remove errors from your report. This will help rebuild your credit and ultimately boost your score. Another aspect of getting a loan is processing. When a loan application is submitted, there is usually a group of loan processors who work for the bank or other lending institution.

You May Also Like

Uncover Your Dream Home: Explore Bangkok’s For Sale Properties

June 25, 2023

Buy a House: A Step-by-Step Guide

October 25, 2022